YAOUNDE, Cameroon: Cameroon’s government has tabled a 2026 budget that will nearly double the country’s fiscal deficit, underscoring growing economic strain in Central Africa’s largest economy.

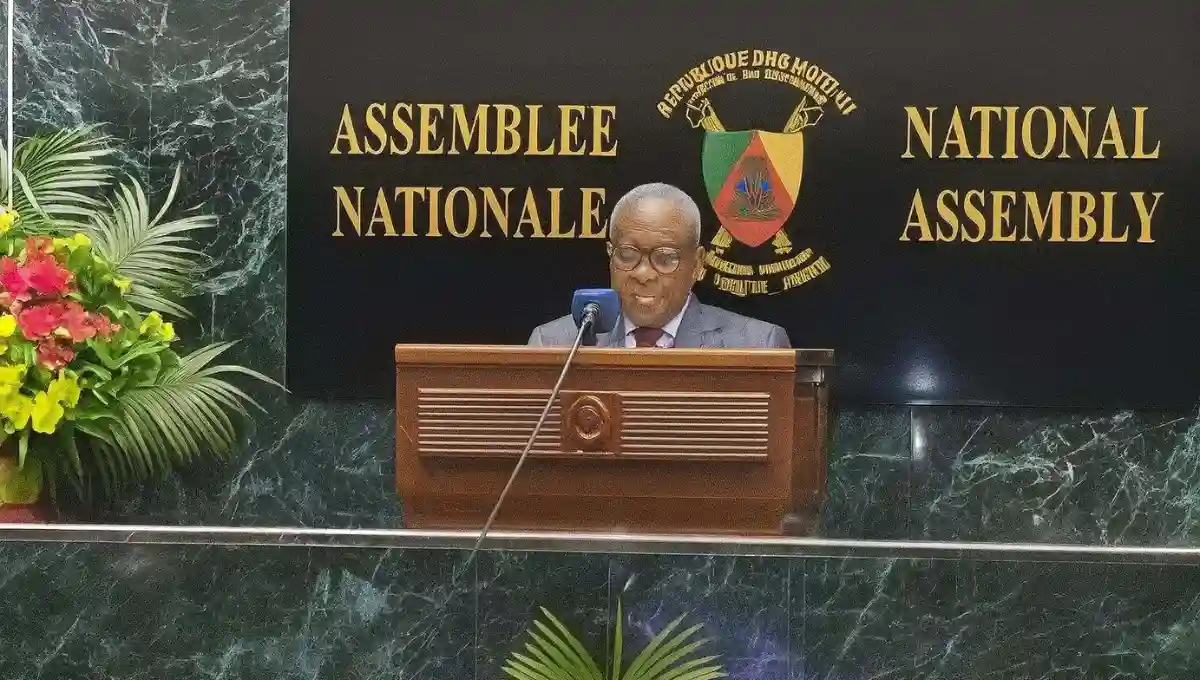

Finance Minister Louis Paul Motaze presented the draft spending plan to the National Assembly on Thursday, projecting a deficit of 631 billion CFA francs ($1.11 billion) for next year, up from 309.9 billion CFA francs in 2025. The proposed budget totals 8,816.4 billion CFA francs, a 14 percent increase over the current year.

The widening gap stems largely from a steep drop in oil revenue, which is expected to fall 26 percent to 612.5 billion CFA francs in 2026 as aging fields produce less and global prices remain volatile. Oil has long been a cornerstone of state income, and the decline is forcing Yaounde to rely more heavily on borrowing.

To plug the shortfall, authorities plan to raise roughly 1,000 billion CFA francs from international markets, commercial banks, and bond issues. Public debt remains below the 70 percent of GDP ceiling set by the CEMAC regional bloc, but analysts warn that sustained deficits could push Cameroon closer to distress levels flagged by the IMF.

Lawmakers are also reviewing higher allocations for civil service salaries, health, education, and debt servicing, which are crowding out funds for new infrastructure and social programs. The government is counting on 4.3 percent economic growth next year, driven by agriculture, construction, and services, to ease the pressure.

Opposition figures and independent economists have called the projections optimistic, citing persistent security spending in the anglophone regions and the lingering effects of global inflation on food and fuel imports.

4 Killed, 10 Wounded in Targeted Shooting at Stockton Family Party; Suspect Remains at Large

The National Assembly, controlled by President Paul Biya’s ruling RDPC party, is widely expected to approve the budget before the end of the year. Implementation, however, will be closely watched by multilateral lenders and credit-rating agencies as Cameroon seeks to avoid a repeat of the 2017 debt crisis that forced an IMF bailout.

Investors tracking Central African markets say the larger deficit could raise borrowing costs and dampen appetite for Cameroonian bonds, though ongoing reforms to broaden the tax base and reduce oil dependence may offer longer-term stability.